Many things in venture are easy to see - the round announcements, the theses, the market maps. But what matters just as much, if not more, are the invisible lessons. The ones that show up quietly in moments of doubt, wavering belief, or when things don’t play out as planned.

I’ve come to realize how much writing helps surface these. It forces introspection and clarity, and makes patterns easier to spot. These notes are raw, but they reflect the ideas I keep coming back to.

Turn the Page

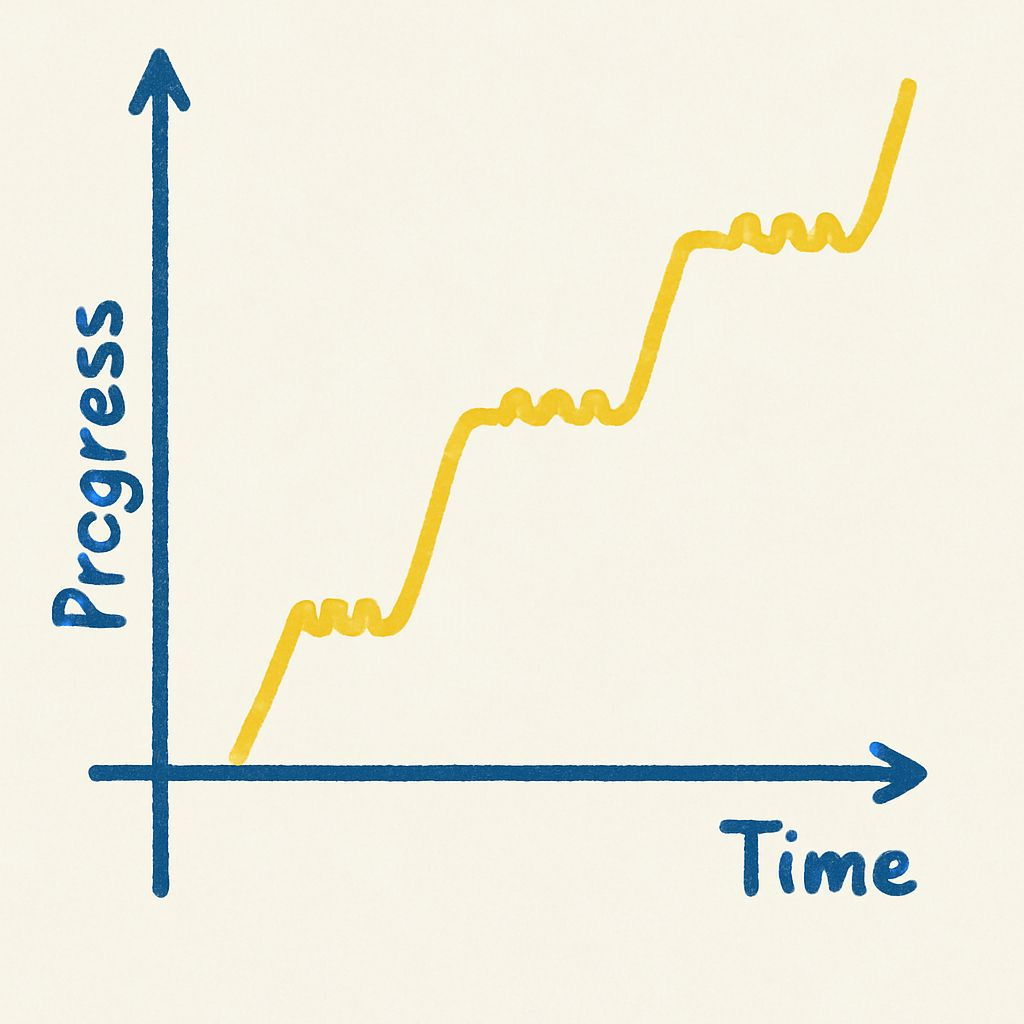

While rhetoric often romanticizes product-market fit as the moment everything accelerates "up and to the right," the reality is more jagged:

With every inflection point, a company soon plateaus. The only way out is to iterate, spark new ideas, and at times, go back on preconceived biases of 'what works'. It's as if the reward is designed to be temporary, a fleeting high before the next challenge. One portfolio company, Instant, hit their first $1M in revenues through a checkout product. But once they sensed it was turning into a commodity, they pivoted - building the retargeting tool that would eventually become the company’s true engine. There is never an escape from the founder's version of the hedonic treadmill, a hallmark of the entrepreneurial journey.

Occasionally, I visualize how great founders approach their day: I imagine the company's journey as a book, with each day as a single page. No matter what happens that day, good or bad, non-linear or flat, great founders turn the page and don't look back. They don’t cling to the wins or ruminate on the losses. They just want to turn the page.

Investors face their version of this, too; the invisible patterns of fear and control-seeking. I’ve caught myself refreshing the metrics dashboard incessantly, texting co-investors to seek reassurance, and asking for more frequent check-ins from founders. But the edge comes from equanimity and detachment. As companies flirt with failure or touch new highs, I view my role not to mirror the intensity, but to steady it.

Winds of Change

Innovation has no map. It's erratic, unpredictable, doesn't follow patterns or timelines, and presents itself in arbitrary moments. Predicting the future in technology is synonymous with the arcade game where with a hammer, a player is tasked with beating down the rabbits as they pop up from 10 different holes; you can try to build conviction that a rabbit will appear right in front of you, but you'll likely miss.

This chameleon-like attribute of technology is what makes it a fulfilling and exciting career. There are perennial winds of change beyond our control, powered by innumerable variables and the relentless pursuit of innovation by obsessive founders all over the world.

However, not all is lost. There is a true constant found in human nature, where understanding what makes people tick can lead to the ‘truth’. Picking which founders to work with is a highly subjective exercise, but for me, intuition fires first, while the mind rationalizes later. Somatic listening plays a fundamental role, where you can feel signals in your own body; the great founders make you sit at the edge of your seat, as you grasp onto their every word. Something I often tell myself: if I don't feel the urgency to invest in a founder, it's likely the founder's team members aren't feeling that same level of urgency.

As winds of change play their role in technology, I often find solace in knowing there is a constant in understanding human behavior. It’s underestimated how large a role psychology plays in early-stage investing. Knowledge helps, but the ability to release your grip matters more; sometimes, you must let go of your frameworks until a founder proves you wrong. A generational founder becomes the anchor - steady amid the turbulence and unpredictability of change.

The Exception is the Rule

Admittedly, when I first started as an investor, I tried to create 'checklists' in my mind. A checklist of what traits embody a breakout founder, mental models for how they must respond to certain questions, and what behaviors were ‘right’. With time, I learned that what is more relevant is to approach each conversation with a blank canvas. To drop any notion or ideas of what I need to look out for, as the drawback of looking for a certain behavior might make you miss something even more special. It reminds me of this famous ‘Gorilla Experiment’: people asked to count basketball passes often miss a man in a gorilla suit walking right through the scene. It goes to show that our biases shape what we see, and more dangerously, what we miss.

Graham Duncan - who spends his life understanding people - puts it best: "You can only read others to the extent that you can read yourself." If you carry blindspots - biases, fears, assumptions - you inevitably project them onto others. This applies to every meeting context in that, instead of approaching a conversation with a 'checklist', to instead surrender, settle the mind, and then move forward with an openness to collect new perspectives. This shift helped me tremendously when evaluating founders.

This openness makes room for the exceptions you wouldn’t otherwise notice. As important as it is to have a firm ‘hold’ on a business model, market opportunity, or even an ownership threshold as a fund, it’s equally important to not be owned by it and allow for disbanding the view completely. History is littered with examples, but this video on Bill Gurley missing out on Google's Series A is a pertinent one.

As you will notice from my writing, venture capital is all about paradoxes. One must have a prepared mind, yet views should be loosely held; have a founder archetype, but always keep wiggle room for exceptions. That’s the beauty of the beast; the invisible game within venture.

This is Water

David Foster Wallace shared a legendary commencement speech at Kenyon College 20 years ago. The heart of the speech, titled ‘This is Water’:

Two young fish are swimming along and they happen to meet an older fish swimming the other way, who nods at them and says, "Morning, boys. How’s the water?"

The two young fish swim on for a bit, and then eventually one of them looks over at the other and goes, "What the hell is water?"

The insight here is that most of the realities of life are the hardest to see, which fail to make us question our wired behaviors or perceptions of the world. In venture, I’ve found the same to be true. All the lessons and ‘right’ ways to approach the craft are often transient, and it’s important to question everything: where to invest, how much to invest, and what makes a certain company special.

I’ve caught myself falling into these traps often. Passing too quickly because ‘it’s too early’, or not willing to dig deeper as the company operates remotely. And even backing a company where I was sure the market timing was right - only to watch it slowly fold. It’s always an illusion to think you know how the future will present itself.

Noticing the water means noticing yourself. Questioning your defaults, noticing hidden patterns, and relying on frameworks to invest, but not sleepwalking within them. The invisible game isn’t about being right. It’s about staying awake - and realizing when you’ve stopped seeing. That’s when the water becomes visible again.

“Look for what you notice but no one else sees.” - Rick Rubin

It’s funny. Before starting my career in venture, I obsessed over literature and media, trying to decipher how great investors think. I tried to decode their mental models and read the right books. Don’t get me wrong, I still do. But I approach it now with less of an academic lens, and more curiosity. It’s still helpful to learn, pick, and choose insights to apply to your own map of reality.

With time, I realize the invisible game is building your map, while having the courage to redraw it, again and again, as the terrain shifts beneath your feet.

Thank you to Nynika Jhaveri for reading and editing my drafts.

Before starting my career in venture, I obsessed over literature and media, trying to decipher how great investors think. I tried to decode their mental models and read the right books. Don’t get me wrong, I still do. But I approach it now with less of an academic lens, and more curiosity. It’s still helpful to learn, pick, and choose insights to apply to your own map of reality.....

Excellent !

This is one of the most honest and insightful reflections on the inner world of venture I’ve read. The reminder that the “invisible game” is less about chasing certainty and more about staying awake—emotionally, intuitively, intellectually—truly resonated. Especially loved the line: “Noticing the water means noticing yourself.” In a world chasing trends and data, the real edge might just be self-awareness. Thank you for sharing these raw, real lessons.